If you're new here, you may want to subscribe to my RSS feed. Thanks for visiting!

Author of What to Eat When You’re Broke and Bloom Where You’re Planted online course

When banks began collapsing one after another back in March, a lot of people were spurred into action. They pulled out cash, moved large sums of money around, and made tangible investments to protect themselves. Then, First Republic failed a few months later. But then something mysterious occurred. People became complacent about the economy.

Maybe it’s because the failures didn’t affect them directly. Perhaps it’s because the government coughed up the money to cover deposits well beyond the FDIC’s promised cap. Or it could be that folks just don’t want to think about our system going totally belly-up, Venezuela-style.

I think it’s a very dangerous mistake to be lulled into feeling that everything is fine.

Not only is our own economy precarious, but the global economy is as well. While things may seem somewhat okay now, we’re sitting on a ticking bomb with a very delicate trigger mechanism. All it will take is a jiggle the wrong way and everything will blow up past redemption.

Here’s why now is not the time to be complacent about the economy.

While things may seem tolerable now, you don’t have to dig very deep to see that things with our economy are anything but okay.

Inflation is exorbitant. Our purchasing power has been eroded dramatically. Rents and interest rates are skyrocketing. We’re looking at a new homelessness crisis – one of formerly comfortable working-class people. The price of heating your home, if you’re lucky enough to have a home, is also hitting record highs. The cost of food and essentials creeps up weekly. Today’s $100 trip to the grocery store buys far less food than last year’s and a fraction of what it bought five years ago. This article outlines some of the increases in the cost of living. This upward trend of expenses shows no sign of stopping.

Finding work is hard, if not impossible. We recently published an article about “ghost jobs,” which make it seem like our economy is loaded with opportunities for those who want to work. Unfortunately, these are just a rigging of the system which the Biden administration uses to demonstrate our “thriving job market.” The jobs do not exist.

Next is the looming implementation of Central Bank Digital Currencies (CBDCs). I wrote about how FEDNOW, which is currently being launched, is the gateway to CBDCs. This transition to digital currency is not far off, and you’ll be hard-pressed to avoid using it. This means your every expenditure could soon be tracked, and financial controls can far more easily be put into place.

Our National Debt has passed $31.8 Trillion dollars. And it climbs by the second. This hurts domestic policies and international relations, leading to eventual destabilization. The interest payments on our debt alone are nearly equivalent to our entire defense spending budget. Incidentally, nearly 30% of this needs to be refinanced within a year. This could potentially lead to a huge crisis.

But still, despite all that, people are blithely going on with their lives.

I think because it doesn’t directly devastate tons of people all at the same time, many are clinging to the illusion that things will be A-okay. We might be paying more for gas and groceries, but we can still function fairly normally. We can still have nice meals, a roof over our heads, and a little bit of money in our savings accounts.

It doesn’t feel like an economic disaster. It isn’t how we expected an economic collapse to look, this slow-motion slip toward the edge where we can still dig our nails in and stay on top of the cliff. We thought it would be a plummet off the cliff to an inevitable crash at the bottom. We thought there’d be an event we could mark on our calendars and say, “This is the day our country collapsed.”

Instead, it’s that whole “death of a thousand cuts” or “frog in a pot of boiling water” scenario. It’s hard to see how bad it is while we’re in it, surviving day by day and staying on top for yet another month. When we have homes, food, bank balances, and retirement funds, we know things are tight, but it still feels okay.

I don’t believe it is okay.

We need to get on top of this ASAP.

You need to stop what you’re doing right now and pay attention to this. Now is not the time to be complacent. Things aren’t just going to gently course-correct. They’ll get worse – far worse – before they get better. Just because you can get by right now doesn’t mean that things won’t become more and more difficult.

Here are some steps you can take.

1.) Cut your living expenses. I’m in a position where I can make this cut a bit more dramatically than some people. I gave up my lease in the US when the price of it went up $550 a month at renewal time. I chose to live in places where the cost of living is extremely low in temporary dwellings so that I could save as much money as possible over the past six months. Now, obviously, this isn’t going to work if you own your home, if you have a job that you go to, or if you have children in school. But you can make your own radical cuts to your finances. Even if you aren’t forced to by necessity, you should consider doing so by choice to build yourself a cushion.

2.) Don’t incur new debt. A lot of people will tell you that becoming debt-free is the best option. For many people, this is the case. However, if you are deeply in debt right now, you may be better off trying to put aside an emergency fund instead of dumping all your money into debt repayment. If you are in dire financial straits, you may need to focus your financial energy elsewhere. But avoid incurring new debt, whatever you do.

3.) Make tangible investments. Instead of socking a bunch of cash away under the floorboards, you may want to consider making tangible investments instead. Real estate, food that will last for a long time, tools, and supplies you know you’ll use may be more useful than saving money that will just continue to decrease in value. A meal is a meal. Your choice is whether those same ingredients cost $3 now or $12 later.

4.) Look into precious metals. I’ve written before about the importance of precious metals for holding your money. Once you have your bases covered with a cash emergency fund and tangible assets, you may want to consider putting excess money into gold and silver that you hold yourself. (Don’t get involved in one of those schemes where a company holds it for you – if you don’t have it, you don’t own it.) For more advice from experts on how to convert some of your savings to PMs, book a free, no-obligation call with my friends at ITM Trading. That’s the only company I recommend for this information.

Even the banks themselves are holding gold.

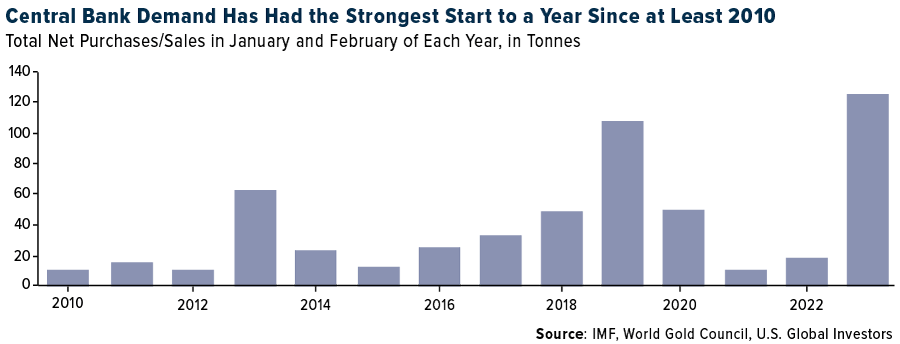

When even the banking system has switched to precious metals, you know that things are changing fast. Central banks around the world are snapping up gold at a record pace.

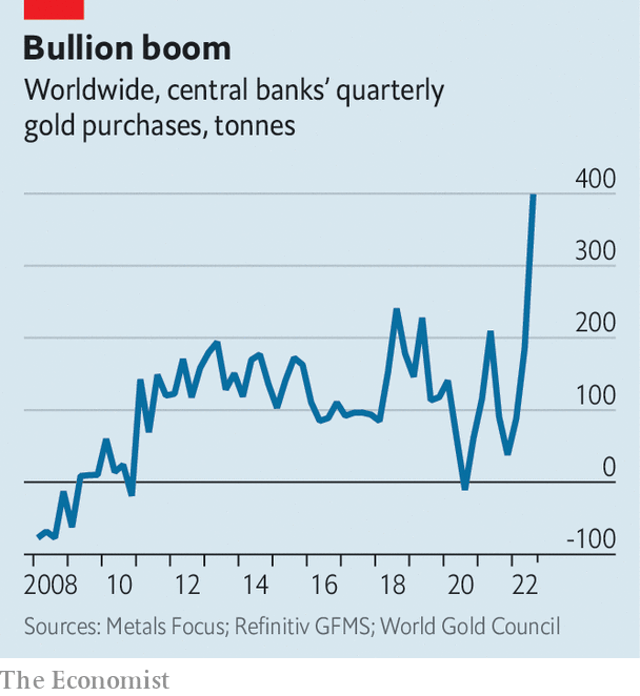

Gold is a way that other countries are getting rid of their US dollars because they see the writing on the wall – the dollar is dying. The Economist reports on one other time gold was purchased at this pace:

In 1968 the London Bullion Market closed for two weeks. The world’s largest precious-metal market had run out of gold, drained by a five-month run on America’s stash by European central banks. The crisis marked the beginning of the end for the Bretton Woods standard that had kept the dollar pegged to gold, and currencies elsewhere to the dollar, since 1944.

Now central banks are furiously buying gold again (see chart). In the third quarter alone 400 tonnes moved into their reserves. That has pushed the total from January to September to 670 tonnes, a pace unseen since the Bullion Market debacle. In May Turkey snapped up almost 20 tonnes in one go. India and Qatar are also ravenous. The metal now makes up two-thirds of Uzbekistan’s reserves, months after it planned to reduce gold to under half. Kazakhstan is also doubling down.

In part this is because gold, snubbed in good times because it generates no yield, recovers its shine in times of volatility and high inflation. In the long run, it is seen as a store of value and, not tied to any individual economy, seems immune to local political and financial turmoil. Central bankers may also think they are getting a bargain. Even though it has resisted better than most, the price of the metal has dropped 3% this year. Gold bugs expect a rebound.

Here’s the chart they mentioned.

The Central Banks obviously know a lot of things we are not privy to. We’d be very wise to look at their actions and not their words in cases like this.

We’ve been warned.

To me, it seems smart to invest in gold while the market is down. You’ll get it for a better price and when things improve – as they always do eventually – you’ll be left with a lot more value than those potentially useless dollars in your bank account.

But I’m no expert. Please don’t be complacent. Do not be lulled into a false sense of security because things are decidedly NOT okay. Talk to experts. You can do so right here. Be careful consulting with financial planners who are so tied to the system they can’t foresee a world in which the system goes sideways.

Make your decisions based on the way things really are, not how you wish they were. I feel like all the events in the market so far this year have been our early warning signs. Sort of like the foreshocks before the massive, devastating earthquake. As preppers, we pay attention to the signs and we know that the faster we respond to a disaster the more likely we are to survive it. A financial disaster is no different.

But what do you think?

Do you feel like the system is going down? Why do you think folks are so complacent about the economy? Do you think that we’ll be able to continue on like we are indefinitely, or do you expect the situation to worsen? What do you suggest people do to prepare?

Let’s discuss what’s ahead in the comments section.

About Daisy

Daisy Luther is a coffee-swigging, adventure-seeking, globe-trotting blogger. She is the founder and publisher of three websites. 1) The Organic Prepper, which is about current events, preparedness, self-reliance, and the pursuit of liberty; 2) The Frugalite, a website with thrifty tips and solutions to help people get a handle on their personal finances without feeling deprived; and 3) PreppersDailyNews.com, an aggregate site where you can find links to all the most important news for those who wish to be prepared. Her work is widely republished across alternative media and she has appeared in many interviews.

Daisy is the best-selling author of 5 traditionally published books, 12 self-published books, and runs a small digital publishing company with PDF guides, printables, and courses at SelfRelianceand Survival.com You can find her on Facebook, Pinterest, Gab, MeWe, Parler, Instagram, and Twitter.

50 Responses

Hi, thanks for the website and article. I’m not sure where to ask this but I’m having trouble accessing the forum, I keep getting a 403 error, “You don’t have permission to access this resource.” Can someone please assist? TIA, Phil

Hi, Phil! We got attacked by spammers and had to close it down for now. We’ve kept all the content and hope to revive it in a few months 🙂

Thanks for this info Daisy. I’ve also tried like 10 times to access forum like Phil and thought it was my computer lol.

Thanks for the update Daisy! I’m in Massachusetts and I’m looking to sell some of my Mountain House #10 cans (13 years shelf life still remaining), any suggestions on where to list them? I put them on Craig’s List nothing is happening there. Any info appreciated…Thanks again, Phil

I’m in MA as well. Depending on what you have, I might be interested. Where in MA are you so I know where to focus the Craig’s list search?

I think I know why you have no takers. I expanded my Craig’s list search and if you are in the greater Worcester area, I think I found you. But after checking current prices on the same Mountain House products, you are asking almost $200 more than it would cost me to purchase fresh products. Perhaps if you reduced your price to about half of what the comparable fresh items are, you might find some buyers. Good luck.

People are always complacent, as long as they have a pickup truck, a sofa, a TV, and a beer in their hand. It’s only when their bubble starts to crumble that they get serious.

Pretty much.

Are we to believe sleepy Joe is the president and that is actually him? Has anyone looked at executive orders from Trump or heard of COG (continuity of government)? Has anyone seen the differences of past inaugurations compared to Joe’s? There is alot to research in just what I’ve given.

The American Empire is swirling around the bowl.This would be like the fall of the Roman Empire with Wi-Fi, except Rome had better roads.

I truly do not understand how holding gold will work, I understand it will hold value better than $ but you’d still have to sell it to get money. How would that transaction happen if for instance grid is down and/or no Internet? Would small chips of gold be sold for goods or services and then how small increments should gold be for this purpose? I find no information about what to do after gold is purchased. Vulnerability to theft is a real concern.

You don’t sell it during the crisis. This is how you hold on to a viable currency through a crisis so that you have something of value afterward. At that time you might be able to sell it to a broker for whatever the cash value is then. It might also be used for trade or bribes – for example, Selco advises a stash of plain thin gold wedding bands to use for this purpose. I don’t have tons of money but when I purchase gold I do so in smaller increments to make it portable, less ostentatious, and easier to use in a trading situation.

Even today, you can find shops that buy used gold and silver, and liquidate your metals into cash. You need to know the value of gold at the time you’re swapping it in and be prepared to pay at least a small premium. During crises there’s always someone in a different position who is likely to trade you for your gold.

As for how much to keep that isn’t something I could answer. I try to treat it like prepping with small regular purchases to build up my personal supply. I keep a certain percentage of my finances this way but everyone’s financial situation is different. You should always have an emergency fund in the current currency (dollars) and treat metals as a savings account. How much to hold would be a good question for the people at that link I gave you.

Does this help at all?

There are small, credit card sized, gold products available which can be broken into small, chicklet sized pieces for barter purposes.

Also look into pre-1964 silver coins, aka “junk silver.”. Still legal tender and look like the coins we use today.

SILVER and GOLD. ummmm….. Well I think along the lines of water that I will be able to drink, purified water, and I think food that I can eat without having electricity in case of an EMP. I think of basic medicine and supplies also. I know that it’s supposed to be good but if you can’t find anyone to buy it and you have no water, food or your basic needs then what good is that?????

I too wonder this, and found that some EU country is minting an incredibly small gold coin, so small, about 1/8″ of an inch diameter. You need a magnifying glass to see the design. See the link, one link of many re this https://coinsweekly.com/how-the-worlds-smallest-coin-was-minted/

Daisy, maybe you will give me a reply to this question. I can’t get investment managers to do it so here goes: if we invest in precious metals all the government has to do is pass a law or sign an executive order banning or confiscating them. It has been done in the past, what’s to stop it from happening again? I wouldn’t put it past them.

Obviously I could never advise you to break the law. Everything in this comment is simply food for thought.

First of all, there are ways of purchasing things that don’t leave a trail. While I do buy some from the people I mentioned, I also have other stuff I’ve picked up from pawn shops and private sales over the years.

Secondly, keep in mind that when FDR federalized it before it was buillion and bars. Not “personal jewelry.” I have long called jewelry my “gypsy savings plan” because that is how the Roma have always transported their wealth. In ancient times, cherished women were given gifts of gold and silver jewelry so that they might have some wealth of their own.

None of these methods of putting back gold and silver is illegal in the slightest.

OPSEC is of the utmost importance here. You don’t want to run around letting anyone know that you have bars stacked to the ceiling in your bathroom closet. Nor, if you aren’t a blogger who writes about this stuff, do you want it to be well-known that you’re an advocate for precious metals. Keep it hush-hush.

Finally, much like gun confiscation, it’s highly unlikely that they’re going to thoroughly search every home in America for this contraband. There simply isn’t the manpower. You can store gold other places than your home safe. You can have a dummy safe with a handful of things and have the real safe better hidden. But just remember that if such a law passed requiring you to turn in your metals, by hiding gold you are definitely risking prosecution if you’re caught.

I realize this isn’t a perfect answer – I don’t think there is one.

There’s absolutely nothing to stop them from banning it again, but if they do, the time to have purchased it and stashed it away has long passed. So if you WERE going to make a move to gold, you’d want to do so while it was still legally available to be purchased.

Look into “junk” silver coins, which are pre-1964 legal tender dimes, quarters and half dollars, made of 90% silver, 10% other metals.

They are still accepted at face value everywhere and are still found occasionally in circulation.

However, they have value for barter at whatever the current price of silver per ounce is, less 10%.

So if silver is worth $10/oz, then one ounce of junk silver is worth $9.

They are in smaller denominated sizes than gold coins and are useful for smaller transactions, they are clearly marked as to face value and are a store of value, being silver.

And they are legal tender.

I started getting a bit complacent myself, especially when i saw eggs for $10 for 5 dozen instead of $35, but a $28 check my credit union wouldn’t cash and a “Q&A” session with my credit union lit a fire under my ass this past April.

I have a credit union outta Houston, where I used to live. Had this credit union for decades after we made the choice to leave Chase. They “chased us away” pun intended, with their fees and overreach into our personal al finances.

Credit union had a Q&A session for members, but it was basically to let us know they were going to be shutting down some branches, rewarding members for their social credit scores and carbon footprints, as well as talked about possibility everything going digital over next few years. They never answered me about the fed coin Biden bucks crap coming in July with that executive order signed in March of 2020 by puppet obiden.

I opened up a 2nd credit union here by me, which ain’t much better , called Brandon over at ITM , and we’re getting laying hens.

Our economy ain’t getting better. Signs of the times point to much worse.

Uh any EO signed in 2020 wasn’t Biden.

It was indeed Brandon who signed the EO on March 9, 2022. You got the perp correct, but mis-typed the year. https://www.whitehouse.gov › briefing-room › statements-releases ›

One thing I don’t see addressed here is becoming a producer of necessities. I believe that we need to get out of the cities and rent or purchase at least a small tract of land. For instance, you can produce food for yourself and to sell it to others. This is an excellent way to stay ahead of inflation because as prices rise you’ll have some of what you need and the ability to buy what you can’t produce yourself.

Learn useful skills, too, like small engine repair, first aid, herbal medicines, baking bread, repairing shoes and clothing, raising small livestock like chickens, pigeons and rabbits, making plumbing repairs.

All of these things can be bartered, even by folks who might not be able to do the heavy work of raising crops, or who might not have access to much land for growing food.

And learn to grow what you can even in an apartment. Check out The Provident Pepper YouTube channel to learn how to raise peppers, green beans and lettuce indoors under inexpensive grow lights.

Some folks are even raising quail and meat rabbits indoors.

And if you can’t leave the city, see about turning vacant lots and flat roof tops into food gardens. Ask folks who do have yards if you can put in a garden in their yard and split the proceeds.

Local businesses and churches may let you do the same. Put container gardens along the edges of parking lots and driveways and on patios and porches. Try stealth gardening.

Folks used to raise pigeons on the rooftops of apartment buildings.

There are many places to squeeze in food producing plants and animals. You don’t need to live in the country to become at least somewhat food self-sufficient.

This is an excellent idea.

Yes! If we produce useful “essential” (starting to dislike that term!) things or have skills for important services MORE than just being a consumer (“useless eater” as they lovingly call us) we should be okay.

OR…stash/grow a lot of food…

Gold is good to hold value but honestly I would choose a good piece of land with off grid potential any day.

This is timely.

I just read an article about people struggling to make ends meet.

And these were not just your lower economic class, but people making in the $60-100k range.

Not just food, but rent and utilities have been going up too really hitting the checkbook.

Read another article about the “pause” in student debt repayments that is set to resume later in the month. Some people have been counting on that “pause” to continue forever and not budgeted that into their monthly fiances.

While MSM would have you believe the economy is doing great and pointing to the unemployment numbers, they ignore the Home Household Survey which tells the real story: More Americans are working second, even third jobs to make ends meet. So it is not more Americans are working a single position, but more Americans working two or three positions.

We are planning on paying off the house at the end of the month. We will have no debt.

Congratulations!

There is great peace in being debt free.

Your sleep will greatly improve.

That’s great if you both are in agreement!!!

That’s awesome, about paying off your house. Congrats. I am concerned about the student loans because I , like a dummy, took out parent plus loan for my youngest son, and while we’ve been pushing him to go to trade school, and he won’t, that loan still has to be paid back. I should make him pay it back.

Technically it’s under your name. So, legally its yours. How much in student loans does he already have? Trade school would have been a good idea. Our small town newspaper had an article about trade schools and how much electricians, plumbers and the like make a year vs student loans. It was really good. Probably the best thing thats ever been in the paper.

Congrats on paying the house off. Huge accomplishment!

We paid the last of ours with the “free money” in 2021. We are debt free too now. We have more freedom to set things up. And I bought goats ? too. Its like a walking food bank!

I think 95% of people do not want to really think of how bad this economy really is. Most people I know, do not stock up their pantry,since they like to eat out multiple times a week.Those who do garden are struggling,since they consider it a ‘hobby”. They also ‘trust’ the MSM personalities, shun alternative media and shut off their thinking abilites.

https://markgresham.substack.com/p/the-sword-of-damocles

I have prepared for this disaster in many ways, but what should we do if we are completely dependent on the government for our monthly checks to live on? We both have SS checks and my husband receives 100% disability from the VA. I am concerned that it will all go away. We do have a 401k that we try not to dip into. Thanks for your answer in advance.

Sadly your question does not have a gratifying answer. Trying to keep things that are ultimately already lost will make this tragedy even worse. Beyond physical and financial preparedness, talk to people that you know and to people that you meet. Even at this late stage increasing the numbers of people wise to the misleading deceit will promote a better ultimate future. Try not to be motivated by fear while remaining informed active and reasonable. Remember and review the tactics and events that brought us to this condition. Draw your own lines in the sand that will never be crossed. https://markgresham.substack.com/p/what-do-they-got-that-we-aint-got

Something that I have only really seen in independent media is De-Dollarization.

I bring this up as last week Kenyan President William Samoei Ruto made the suggestion of African nations trading in their own currency rather then the US dollar.

While some may shrug and say so what, it is not just Kenya.

Saudi Arabia announced they would be open to trading in other currencies other than the US dollar.

China and Russia have too.

At last count I believe it to be 31 nations are seeking to join the BRICS+ and others are showing interest in joining or making deals with the SCO.

Most say de-dollarization is not going to happen over night, in 2001 73% of the US dollar was held globally in reserve currency.

By 2020 it was down to 55%.

Then in 2021 it fell to 47%. Guess what happened in 2021.

According to some, if that trend continues it will fall to 30% by 2024.

The question is, what happens when all those US dollars come back to the US?

Some speculate hyperinflation.

No one really knows as there is not a precedent to look back on.

The Fed firing up the printing press is not going to work. Might even make things worse.

The government handing out checks to everyone? We saw the result of that during COVID, i.e. inflation.

What is the answer, I have no idea.

Prep. Prep. And then prep some more.

Some may have become complacent. But many are just struggling so hard to keep their head above water. Staying informed and prepping as able is the best some can do.

Rather than trying to outguess the economic system, I find it more productive to focus on gaining skills or learning new skills. At any point in time, a person can lose ‘everything’ due to factors beyond their individual control. But your knowledge and skills are ‘yours’ and portable. Learn to sew, knit or crochet. Learn woodworking, plumbing, basics of electricity. Learn how to repair things. Learn to garden, can, care for animals. And right now while the internet is still working you can even learn about all these things for free, online whether you live in a city or rural. When economic systems break down, skills will still have value and your knowledge of ‘how to’ will get you through tough times. Get in good physical shape. Learn to make friends and care for others. These are all things that can help you thrive if/when the economy tanks. That’s my approach.

My 2000 copyrighted book “The Gold Clause” by Brooklyn law school professor Henry Mark Holzer explained that in 1933 when FDR issued his gold theft order, there were two types of gold not covered. He did not dare confiscate gold coins with numismatic value since they were a favorite holding of some of his uber-wealthy campaign supporters. The second exclusion is most interesting to us mere mortals — that being gold that was held in other countries where FDR had zero jurisdiction.

Today in the face of skyrocketing inflation (truthfully labeled as the result of government sanctioned and protected counterfeiting of the fiat currency to steal purchasing power from the population in addition to what published taxation takes) we are facing the possibility of the same kind of hyper-inflation that destroyed the currency of Venezuela, Zimbabwe, and even 1920s Weimar Germany. What new for us is the introduction of electronic money (CBDC) with all the gross tyranny it brings. The ability of our Fed to print (electronically) existing US dollars into worthlessness is intended to force most of the population into homelessness and starvation unless they accept the replacement constitution-destroying digital money (CBDC).

A few people are trying to organize independent rural communities that can survive with blockchain-based crypto currencies such as Bitcoin … as well as barter materials and skills. My guess is that when the 2024 election is vote-corrupted as badly as 2020 was (much like how Chavez got into office in Venezuela a decade ago, and how Lula got into office in Brazil (after which the Biden administration bragged about helping corrupt the Brazilian vote to make Lula’s victory possible), the US IRS will probably then get their 87,000 fully armed IRS agents to go after the millions of dissidents (including those in such independent communities).

So is there any way to protect the purchasing power of whatever cash we now hold and are still accumulating?

The lessons from FDR’s 1933 gold theft come to mind — including the exclusion of gold held in other countries. A few years ago a UK-based company set up a gold bullion system in Switzerland to be held in a Brinks vault. They arranged for Mastercard to be usable in a growing number of countries where purchases could be made, backed by an individual’s purchased gold bullion in that globally secure vault. Only about 4-5 years ago was America added to that list of countries. That announcement was made at the International Boat Show in Ft Lauderdale, FL. Since that time the UK company has even added a field office in Colorado to better handle user questions and support. Their website is

https://glintpay.com/us

While that use of gold-backed business will probably not work for property taxes, utility company bills, etc or replace digital Social Security payments, the Glintpay Mastercard should allow reasonably private gold-backed Mastercard transactions without having to carry around chunks of gold bars, etc. And as the number of countries that Glintpay serves continues to grow, such a gold-backed Mastercard could also be invaluable in other countries to which one might travel or emigrate. I think that glintpay.com website is well worth looking over.

Finally the prepper article below that just appeared this morning seems highly relevant to today’s discussion:

Twelve things you can do right now to be more resilient against collapse, famine and nuclear war, June 20, 2023 by: Mike Adams

https://www.naturalnews.com/2023-06-20-twelve-things-you-can-do-resilient-against-collapse-famine-nuclear-war.html#

Plus MANY cited resource links.

–Lewis

People are mentally fatigued over years of continual stress … but do not let up this is very similar to the “slow rolling”collapse in Venezuela that we were warned about.

As I’ve mentioned before, I work for one of the 5 largest US banks but on the advisor side. Been here for 13 years and have never trusted enough to open a single account. We’re required to report outside accounts we hold but I don’t and will refuse to do so. Our customer service is horrible and I’ve tried to make changes but apparently they don’t care. Of course we still get all the emails of how great last quarter was, blah blah blah. But there have definitely been negative changes. Most recently 15 people in my department alone were “displaced” which apparently means they hired people in the Philippines and India to replace the US workers. This also happened recently to our tech support. So yeah I see things from the inside and not liking it at all. Sad that I’ve never been proud to say where I work.

I have been investing in tangible assets that allow me to focus on my little homestead, while also paying down my debt. Its no fun, as I do not have extra cash to play around with but I can also see my goals getting accomplished. The toys can wait

Why do you think folks are so complacent about the economy? It is “normalcy bias” where many people mistakenly believe that “Uncle Sam” keeps the economic engine humming along in perpetuity. Tragically, we are heading toward World War III and the end of normality.

THIS!!

–>I have long called jewelry my “gypsy savings plan” because that is how the Roma have always transported their wealth.<–

You are the bomb, Daisy!! That is exactly how I look at gold and silver. It can be beautiful, it's personal, and it is easily transported and hidden.

Bad news everyone, The Fed Chairman Jerome Powell said more interest rate hikes are to be expected to fight inflation and it has a long way to go.

Some economists are saying a recession is expected in the latter half of this year.

Some say to many Americans, it already feels like it is here.

Most people who bought a house with a low interest rate are now effectively trapped in their current location because buying at double or triple the current interest rate would be insane. I don’t see housing prices decreasing either, which should be happening with the higher cost of a mortgage.

I just had a conversation with friends yesterday while grilling out.

Exactly!

My daughter bought a home a year and a half ago and got a great rate. But now finds herself in the same position if she wanted to sell and get a bigger house.

Told her it would be 5 maybe 10 years (if ever, I said to myself) before she could sell and get a rate as low as what she has now.

“Most people who bought a house with a low interest rate are now effectively trapped in their current location because buying at double or triple the current interest rate would be insane.”

They also have a relatively fixed cost going forward. Tomato…Tomato.

“The Fed Chairman Jerome Powell said more interest rate hikes are to be expected to fight inflation and it has a long way to go.”

What he’s not saying is even more important that what he is saying.

And that is: “Saudi Arabia, Kenya, and 10 SE Asian nations are dumping or already have dumped the dollar. Mexico, Egypt, and possibly France are applying for BRICS membership. It seems that nobody wants to use our “money” to conduct commerce anymore so we can export our debt. Sanctions aren’t having the affect they used to. I mean, for Pete’s sake..Iran is now acting like they’re the federal reserve and using their own SWIFT system to conduct exchange transactions for a fee with other nations. So, in order to keep stupid Americans from finding out that the world is rejecting our worthless, comic bookishly flimsy currency and keep you all going into unnecessary debt for every day necessities.. I’ll have to raise rates on the dollar some more, I’ll just tell everyone it’s because I’m “fighting information” (er, um..), I mean “inflation”. P.S. I detest you all and hope your children starve.”

Jim, that is about how it feels right now. France though in the BRICS? wOW! I will have to look that up.