If you're new here, you may want to subscribe to my RSS feed. Thanks for visiting!

Have you ever gone to the mailbox the week after Christmas and discovered a fist full of bills? Have you thought back about the things your gift recipients enjoyed or the items that were just filler so they’d have plenty of gifts to open? (Stocking stuffers come to mind here.)

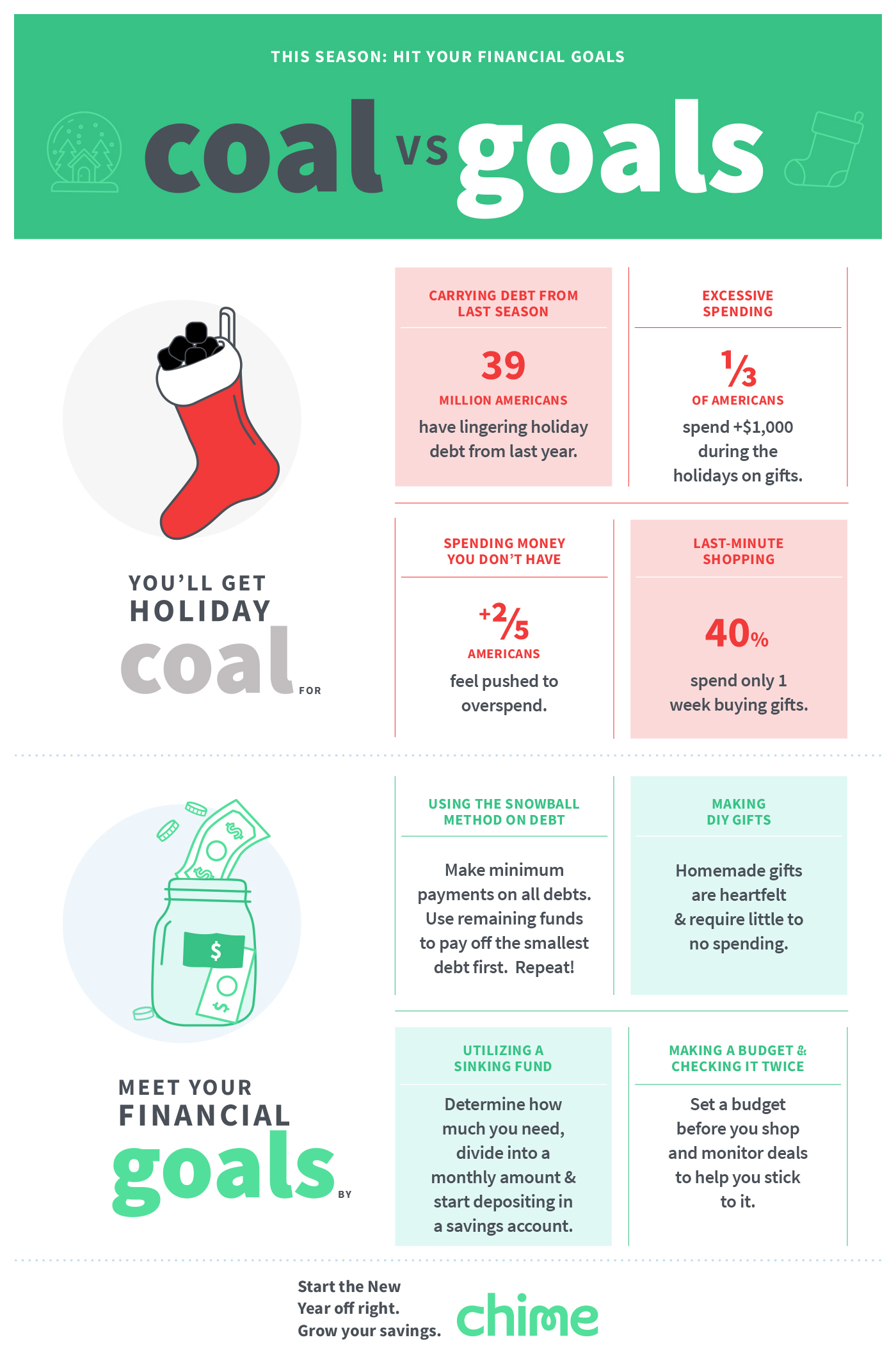

Every year, 39% of Americans are still paying off last year’s holiday gifts when they start this year’s ball rolling and get themselves even deeper into debt. This is no way to start off a new year.

This infographic has a few tips that will have you reaching goals instead of getting coal in your stocking.

For more information on holiday savings, check out Chime

Here are some resources for holiday budgeting:

- The Traps Retailers Use to Get You to Exceed Your Christmas Budget (and How to Avoid Them)

- Have Yourself a Thrifty Little Christmas (and a Debt-Free New Year)

- 20 Free and Festive Ways to Wrap Gifts

- How to Make a Festive and Frugal Holiday Dinner from the Pantry

- How to Use the Snowball Method to Get Out of Debt Quickly

Remember…

Christmas is just one day. If you usually overspend, set expectations for your family that this year is going to be different. It’s not worth being buried in debt for an entire year just because society pushes you to spend, spend, spend. You’re still a good parent, partner, family member, and friend if you stick to your budget.

Remember to focus on the things that really matter this year.

9 Responses

“Make minimum payments on all debts. Use remaining funds to pay off the smallest debt first. Repeat.”

I disagree strongly. Making the minimum payment on ALL such debts legally acknowledges your admission of their legitimacy — and some debts are not. (That’s part of why debt collection agencies will try desperately to get you to pay even some tiny amount at first.) The biggie is often medical debt, which very often is badly inflated, often containing double billing and bills for services and products not provided. An online search of this topic will pull up plenty of such accounts going back decades. I’ve seen articles that claim anywhere from 70% to 90% of medical bills have this problem.

There are some strategies for medical debt worth knowing. There are highly capable companies that will either 1) negotiate on your behalf to reduce such seemingly complicated and impenetrable debts, or 2) teach you how to do that negotiation yourself.

Another strategy which you should save for only the largest and most overwhelming debt is bankruptcy, partly because that can only be used once every 7 years (I think). Desperate people are often put off because of the stiff legal fees that attorneys charge. However, there are non-profit organizations that will do the work for you, letting you bypass the attorney fee (but not the court fee).

A final strategy only works if you use it BEFORE getting a bad bill. Learn how to structure your assets so that you are judgment proof. That is a whole body of legal knowledge that I’ve only seen from a distance. (Texas, for example, has a homestead law that protects your owned house as long as you’re living in it, but if you move and rent out that owned house, it becomes fair game for a court judgment. What works in your state may vary wildly, etc.)

I also disagree with Dave Ramsey’s “snowball method” on paying off the smallest debt first. (I have his book “The Total Money Makeover” — his chapter on his snowball method begins on page 109.) That is designed to give you the earliest possible emotional reward — for people who need that kind of motivation. A better strategy that will pay off for less money in the long run is starting with the highest interest rate debt, and working your way through the debts on that basis. I would trade away Dave Ramsey’s early emotional kick in exchange for a lower total cost in the long run any time.

–Lewis

@Lewis,

I have are we are currently using the “Snowball” method in our finances but as you point out, everything I have read (and our financial advisor) says to pay off the highest interest rates first, once paid off, roll the money that was going toward that bill into the next higher interest rate.

Using this method, we will be debt free (we will still have the house payment) by spring next year.

I too disagree with the snowball method – paying the highest interest for the longest time is just plain nuts. I’d also encourage all of us to know our state’s statute of limitations (and laws) on debt collection. Of special importance is any debts discharged in bankruptcy (keep your opinion on bankruptcy to yourself. Starting with the highest office of this country, plenty who have filed bankruptcy). Be strong and smart IF you get a call saying you owe money. Request the caller send you proof. Then verify.

I agree with the author, put yourself/family on a budget and stick to it.

The wife and I prefer to give each other a list of what we would like for Christmas with the intent of using that list to stay inside the budget. Or maybe get one or two items not on each other list that we think they might like or be surprised to get.

We got everything paid off by paying off the higher interest rates first, then the mortgage. We managed to save enough for our daughter’s wedding in November so this Christmas was pretty tight. We had a budget, took wish lists, and managed to get gifts without adding to our debt. They didn’t get everything on their lists (a first for us) but the budget really kept us in line. It is awesome to know in the new year we won’t have any extra debt.

There’s another aspect to gift-giving that’s not often discussed. When people reach the “seniors” stage of their lives, the accumulation of “stuff” takes on a different meaning. It’s when their kids have long since flown from the nest, the need for the mega-sized house has long been eclipsed, downsizing estate sales become common, and vintage/antique dealers smell fresh meat at the opportunity to pick up “new” inventory. A couple of decades back one nationally known antique dealer said that from about age 62 and on, lots of people begin that slow downsizing process and become his favorite source of stuff.

For such people, the gift of physical things no longer has the same meaning. The unsaid phrase of “Oh, thank you so much for that ugly sweater” rings loud and clear. The oft-cited number of the baby boomer generation reaching retirement age is about 10,000 per day. What is more valuable to you and to them is your time — time to listen and learn from them. Some love to tell their stories. Some have immense knowledge of where their ancestors came from and why they moved here, or wherever. Consistently, article after article emphasizes that youngsters develop their strongest sense of self by learning about their family history, and the senior generation is the most likely source of such knowledge, even if their insights are incomplete. A famous saying in genealogical circles is that a genealogist can take your family history back as far as your money can go. Well, some of that cost can be saved through conversations with your oldest generation.

In other words, the gift of your time is worth immensely more to both the seniors in your family (and to you) than the gift of physical “stuff.” And there’s no ballooning credit card bill attached to the gifts of your priceless time for them.

–Lewis

This is very true, Lewis. My children’s grandparents on both sides are at this point in life where they’ve specifically asked us not to get them more “stuff.” Thanks for adding this!

@Lewis,

Well said.

IF we get my parents anything, it might be a meat and cheese basket and a fine bottle of wine. Gift certificate to their favorite restaurant.

Good article with lots of good advice.